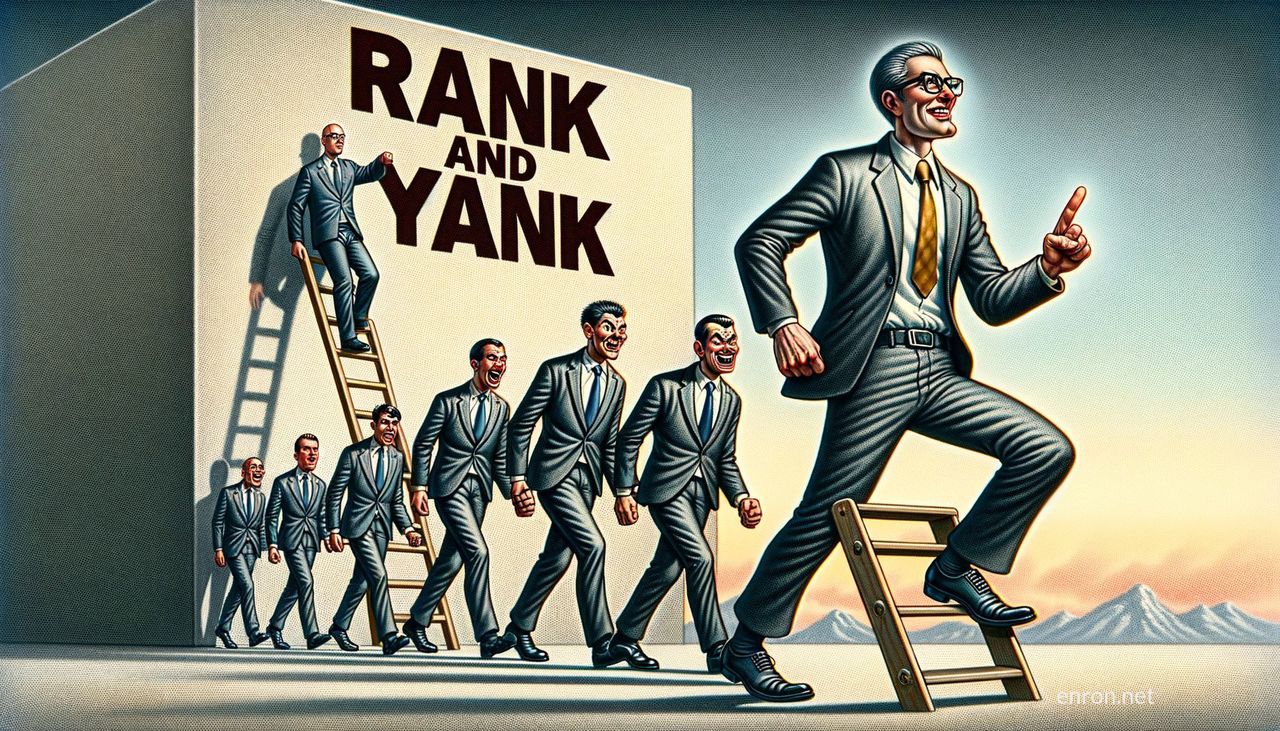

Rank and Yank: Inside Enron's Controversial Employee Evaluation System

Uncovering the Impact and Controversy of a Ruthless Corporate Practice

The Rank and Yank System: Enron's Controversial Employee Evaluation Method

Prologue

The Enron scandal, one of the most infamous corporate collapses in American history, left in its wake a multitude of lessons on corporate governance, ethics, and accountability. Yet, one aspect that is often overshadowed by the financial machinations and sheer corruption is the company’s internal culture and management practices. Central to this was Enron’s adoption of the "Rank and Yank" system for employee evaluation—a method that promised to drive performance but ultimately fostered a toxic environment of fear and competition.

What is Rank and Yank?

The Rank and Yank system, also known as forced ranking, is a performance management process that stacks employees against each other, sorting them from best to worst. Introduced to Enron by CEO Jeffrey Skilling, the system was intended to mimic the Darwinian concept of "survival of the fittest." Every six months, employees were graded on a curve and sorted into three categories: the top 20% (who received praise and bonuses), the middle 70% (who were considered adequate), and the bottom 10% (who were either warned to improve or shown the door).

This method was inspired by similar practices at other firms, most notably General Electric under Jack Welch. However, while GE's implementation sometimes bore positive results, Enron's iteration added a layer of brutality and cutthroat competition that fostered an atmosphere of paranoia and betrayal.

From Growth to Greed

Enron’s meteoric rise in the 1990s was fueled by innovation, but it also depended heavily on aggressive ambition and ruthless behavior, encouraged by its performance management practices. Employees were driven to exceptional lengths to avoid being in the bottom 10%.

Jim Chanos, a prominent short-seller who predicted Enron’s collapse, noted that the Rank and Yank system likely caused employees to hide bad news or manipulate financial figures to save their careers. The culture of fear driven by the expectation that they could lose their job every six months led to enormous internal pressure to perform at any cost—even if it meant ethical compromises or cutting corners.

The Dark Side of Forced Ranking

For many at Enron, the Rank and Yank system incited a state of constant anxiety. Enron prided itself on hiring the best and the brightest from top business schools, yet even these recruits were not spared the relentless demand for exceptional, almost unrealistic results.

It fostered an environment where collaboration took a backseat to individual success. Instead of working together, employees often saw each other as direct competitors. Trust became an obsolete concept, replaced by a culture of scheming and backstabbing. Managers would sometimes manipulate rankings to protect their favorites or punish detractors, leading to deep-seated resentment and a loss of morale across teams.

John Beard, a former Enron employee, recounted to investigators how the atmosphere turned from collegial to toxic. "You were encouraged to 'eat what you kill,' with no regard for the ethical implications. If a colleague shared information that could harm their ranking, it wasn’t unheard of for that information to be 'accidentally' lost or manipulated."

The Impact on Innovation

Ironically, the very system designed to promote excellence and innovation often stifled creativity. The constant need to prove oneself or face termination led to short-term thinking and risk aversion. While Enron is often remembered for its ground-breaking ideas in energy trading and Internet businesses, many of these ideas were pursued without thorough due diligence because employees were under inordinate pressure to deliver immediate results.

Moreover, fear of falling into the bottom percentile led employees to avoid experimenting lest they fail and be penalized. “Rather than fostering an environment where learning from mistakes was possible, Rank and Yank pushed people to cover up failures,” says Bethany McLean, co-author of "The Smartest Guys in the Room," an exposé on Enron’s collapse.

Ethical Compromises and Misaligned Incentives

Performance metrics under the Rank and Yank system were often deeply flawed, focusing on short-term gains at the expense of long-term stability. This led to aggressive accounting practices and outright fraud. Employees began to focus not on creating genuine value but on manipulating earnings reports and financial figures to appear successful.

Trader Lou Pai, known as the “invisible CEO,” exemplified the ill effects of this system. Pai was held in high regard within the company for continuously hitting his profit targets. However, it eventually came to light that these targets were met through deceptive accounting and inflating earnings, ultimately contributing to Enron's downfall.

The Human Cost

The system's psychological toll on employees was immense. High-performing employees lived in constant fear that a single misstep could cost them their job. Susan Campbell, who worked in Enron’s finance department, recalled how colleagues developed health issues, burnout, and severe stress. The human resources department became colloquially known as the “Death Squad” because getting called in almost always meant termination.

Moreover, employees who fell into the bottom 10% bracket faced a tough professional reality. The frequency of evaluations meant high turnover, with those fired often struggling to find new positions due to the poor market perception about their capabilities. The system not only marred their time at Enron but cast long shadows over their future career prospects.

Conclusion: Lessons Learned

In retrospect, Enron’s Rank and Yank system offers critical lessons in the balance between competitive performance management and sustainable corporate culture. While setting high standards can indeed drive performance, the creation of an excessively high-pressure, adversarial atmosphere can produce exactly the opposite—ethics violations, innovation stifling, and a toxic work environment.

As companies worldwide continue to refine their employee evaluation strategies, Enron’s debacle serves as a cautionary tale about the dangers of extreme measures in management practice. Systematic checks and balances, fostering a culture of trust and collaboration, and emphasizing long-term value over short-term gains are imperative. The legacy of the Rank and Yank system, tarnished by its association with one of the most massive corporate frauds, should remind us to put humanity back into human resources.

Epilogue

Enron’s story, especially through the lens of its aggressive employee evaluation methods, underscores that the ethical foundation of a corporation is just as crucial as its financial backbone. The Rank and Yank system, while designed with the intent to create a high-performing culture, instead reveals the peril of unchecked ambition and the consequent fallout—a lesson writ large not just for Enron but for the entire corporate world.